Digital out-of-home (DOOH) has moved from "nice-to-have" to a core part of modern media plans. Global DOOH revenue surpassed roughly $20B in 2024 and is projected to nearly double to around $39B by 2030, growing at a double‑digit CAGR. In the US, DOOH now accounts for about one‑third of all out-of-home (OOH) ad spend and is one of the fastest‑growing traditional media channels.

For brand marketers, that growth is driven by one thing: DOOH combines the brand impact of OOH with the targeting, flexibility, and measurability of digital advertising.

What Is DOOH Advertising? An Overview

Digital out-of-home (DOOH) advertising refers to ad content delivered on digital screens in public or semi-public spaces, such as roadside digital billboards, transit screens, mall displays, airport networks, and screens in venues like gyms, offices, and clinics.

The Out of Home Advertising Association of America (OAAA) defines DOOH as digital displays outside the home that carry advertising and whose content can be updated remotely using digital technology.

That means creative can be swapped or updated centrally in near real time, screens are connected to software that manages schedules, playlists, and delivery, and campaigns can be planned and bought using data (location, audience, time of day, etc.), increasingly via programmatic pipes.

DOOH builds on traditional OOH's core strengths, including high reach, real‑world presence, and strong visual impact, while adding digital capabilities like dynamic creative, granular targeting, and measurable outcomes.

How Does DOOH Advertising Work?

Behind every DOOH placement is a technology and data stack connecting brands to physical screens. At a high level, a DOOH campaign typically involves:

Screens and media owners

Media owners operate networks of digital screens such as roadside, transit, retail, place‑based, and more. They control the physical inventory, screen specs, and available impressions.Content management and ad serving

A content management system (CMS) and ad server determine which creative runs on which screens, at what times, for how long, and in what rotation, and how to apply rules like "only show this ad when it's sunny" or "only in locations near grocery stores."Buying methods: direct, guaranteed, and programmatic

Advertisers can buy DOOH directly from media owners (insertion orders, fixed schedules), through agencies on behalf of brands, or programmatically, using demand-side platforms (DSPs) and supply-side platforms (SSPs). Programmatic DOOH platforms managed a global market of about $7.5B in 2024 and are forecast to grow to nearly $46B by 2034, a ~19.8% CAGR. Recent data indicates that around half of all DOOH campaigns are now bought, at least in part, through programmatic channels.Data‑driven targeting and optimization

DOOH targeting increasingly uses mobile and location data (footfall, audience movement patterns), context signals (weather, time of day, day of week, local events), or audience segments (commuters, shoppers, sports fans, business districts). The OAAA notes that modern OOH uses geolocation, audience measurement, and advanced analytics to improve targeting, insights, and ROI.Measurement and attribution

Measurement connects DOOH exposure to outcomes such as store visits, website visits, searches, app activity, and sales lift or conversions in specific markets. OAAA's 2024 Harris Poll study found that 76% of consumers reported taking action after seeing a DOOH ad, including watching video content, visiting restaurants or stores, and making purchases, and 74% of mobile users took action on their phones after DOOH exposure.

With the right stack and partners, DOOH behaves much more like a digital channel than a static billboard, just with physical‑world presence as its superpower.

Types of DOOH Advertising

Modern DOOH inventory spans a wide range of environments. Here are the core formats marketers tend to activate.

Roadside and Highway Digital Billboards

Digital billboards are the largest and most visible DOOH format. Globally, billboards represent the largest DOOH format segment by revenue. They deliver large‑scale reach among drivers and commuters, ideal for brand awareness, product launches, and tentpole initiatives.

Campaigns use dayparting (morning vs. evening commutes), traffic patterns, and contextual triggers (e.g., sports scores, weather) to keep creative relevant and high-impact.

Street Furniture and Urban Panels

Street‑level DOOH includes bus shelters, digital kiosks and information panels (also called urban panels), newsstands, and phone kiosks. These placements deliver high pedestrian reach and dwell time in dense urban areas, near retail, dining, and entertainment districts. Precedence Research reports that outdoor DOOH formats accounted for roughly 68% of global DOOH revenue in 2024.

Transit and Travel Screens

Transit DOOH appears at subway and train stations, airports, buses, trams, commuter rail, and ride‑share and taxi networks. Transit is one of the fastest‑growing OOH categories in the US, with double‑digit revenue growth driven by digital formats. These environments offer captive audiences and strong frequency, especially among commuters and travelers.

Retail and Place‑Based Screens

Place‑based DOOH includes screens in retail stores, malls, supermarkets, gyms, healthcare waiting rooms, pharmacies, office buildings, elevators, campuses, and entertainment venues. Precedence Research highlights place‑based media as one of the most lucrative and fastest‑growing DOOH segments, driven by advertisers' desire to reach consumers closer to the point of decision and purchase.

Landmarks

These are iconic, large‑format digital installations in high‑profile locations, including Times Square, major stadiums, city centers, and landmark intersections. While inventory is limited and premium‑priced, spectaculars deliver outsized brand impact, PR value, and social amplification. They're often used for tentpole campaigns, launches, or high‑impact brand moments rather than always‑on DR efforts.

Benefits of DOOH Advertising

Massive Real‑World Reach and Visibility

Global OOH spend reached $41.9B in 2023, up 16% year‑over‑year, and now represents about 5.2% of total global ad spend. In the US, OOH revenue surpassed $9.1B in 2024, the highest volume ever recorded. Within that, DOOH is the main growth engine. DOOH represented about 34% of US OOH spending in 2024, up from 33% the prior year, and its revenue grew 7.5% year‑over‑year. OOH also maintains incredibly high visibility with real consumers. An OAAA study found that more than 90% of US travelers noticed OOH advertising in the past month, and 80% noticed it in the past week.

For brands battling declining reach in fragmented digital environments, DOOH provides large, real‑world audiences at scale.

Strong Consumer Favorability and Engagement

Consumers prefer DOOH to most ad formats. An OAAA/Harris Poll study found that 73% of consumers have a favorable view of DOOH ads. In fact, it’s more favorable than TV/video (50%), social media (48%), online (37%), audio (32%), or print (31%).

80% are likely to take action after seeing DOOH content they find entertaining or visually appealing. Those actions are meaningful, not just a "soft" interest. 76% of respondents said DOOH prompted them to take action recently, and among mobile users, 74% took action on their mobile device after exposure. In other words, DOOH attracts attention and drives concrete behaviors.

Flexible Creative and Contextual Targeting

Unlike static OOH, DOOH creative can be:

Dynamic – Swap messaging by time of day, weather, inventory levels, or promotions.

Contextual – Trigger different creatives near events, venues, or locations (e.g., game‑day messages near stadiums).

Localized – Customize copy for neighborhoods, languages, or micro‑regions without new print runs.

Digital platforms and programmatic buying make it straightforward to rotate multiple creatives, test variations, or run logic rules based on context signals. This flexibility supports retail offers tied to dayparts, streaming or entertainment tune‑in near showtimes, weather‑triggered messages, and event‑based creative for sports, concerts, or holidays.

Data‑Driven Targeting and Omnichannel Synergy

DOOH sits at the crossroads of physical movement and digital behavior. Modern DOOH planning combines:

Location intelligence and mobility data – Understand who passes specific screens, when, and how often.

Audience segments – Build or activate segments based on behavioral and location patterns.

Cross‑channel orchestration – Align DOOH with mobile, CTV, and social campaigns to reinforce messaging and sequence creative across channels.

OAAA emphasizes that OOH is now a "full partner in integrated media planning," especially as mobile and digital channels grow. When layered with mobile retargeting or CTV, DOOH can introduce or reinforce the brand in real‑world moments, drive search and site visits as a primary offline trigger, and support retargeting based on DOOH exposure (when privacy and data policies allow).

Proven Impact on Online and Offline Actions

Beyond awareness, DOOH consistently drives measurable actions. The OAAA's broader research has found that OOH is among the most effective offline channels at driving digital activity such as search, site visits, and social engagement.

OOH's contribution is especially powerful relative to its share of spend. OOH's share of global ad spend is just 5.2%, yet it over‑indexes in driving online engagements and brand outcomes compared with television, radio, and print. For performance‑oriented brand marketers, that means DOOH can serve as a high‑leverage top‑ and mid‑funnel driver that lifts digital performance, not just a brand‑only investment.

Brand‑Safe, Fraud‑Resistant, and Always On

DOOH has structural advantages over many other digital channels:

Cannot be blocked or skipped – DOOH cannot be blocked, skipped, or viewed by bots, giving it a reliability advantage over many programmatic display environments.

Brand‑safe environments – DOOH screens sit in curated, physical locations rather than user‑generated content feeds.

Persistent presence – Screens are "always on" during defined time windows, continually delivering impressions as people move through the environment.

For brands worried about ad fraud, brand safety, and the erosion of cookie‑based targeting, DOOH offers a more stable channel grounded in real human movement.

Efficient Reach and Strong Economics

DOOH offers competitive cost‑per‑thousand impressions (CPM), particularly in high‑traffic locations and urban areas, and OAAA analysis highlights efficiency as one reason it has outpaced other traditional media in growth.

Why Is DOOH So Popular Today?

Several macro trends are pushing DOOH into the marketing mainstream.

Shift Toward Privacy‑Safe, Real‑World Signals

As third‑party cookies deprecate and identity solutions evolve, marketers are seeking privacy‑safe channels grounded in aggregated data and real‑world behaviors. DOOH uses anonymized mobility and audience data rather than individual tracking, aligning well with emerging privacy standards.

Urbanization and Screen Proliferation

Rapid urbanization, infrastructure investment, and smart‑city initiatives are increasing the density of digital screens worldwide, especially across North America and the Asia‑Pacific. North America held about 37% of the global DOOH market in 2024, while Asia‑Pacific is projected to grow at roughly 11.8% CAGR, supported by smart‑city investments and high population density. More screens in more environments mean more opportunities to reach valuable audiences during daily journeys.

Programmatic and Automation

Programmatic DOOH has shifted buying from manual, screen‑by‑screen negotiations to automated, data‑driven decisioning. The programmatic DOOH platform market was valued at around $7.5B in 2024 and is forecast to grow nearly sixfold by 2034. A global study cited in recent trade analyses predicts DOOH could account for around 42% of total OOH revenue by 2025, underscoring the rapid digitization of the channel. As programmatic penetration grows, DOOH becomes easier to plug into existing digital workflows, budgets, and attribution models.

Consumer Preference for High‑Quality, Public‑Space Media

The Harris Poll shows that consumers not only notice DOOH but also prefer it to many other ad formats. High‑quality creative in public environments tends to feel less intrusive than ads interrupting content feeds or video, making DOOH a rare channel where impact and favorability can both be high.

Where Can I Find the Best Digital Out-of-Home Advertising Solutions?

Because DOOH spans thousands of screens, multiple markets, and varied formats, most brands don't buy placements one at a time. Instead, they work with partners that aggregate inventory, provide data, and handle execution.

When evaluating DOOH solutions, look for:

Scale and diversity of inventory

Access to a broad mix of roadside, transit, street furniture, and place‑based screens across your priority markets. This allows for both broad awareness plays and precise, venue‑specific targeting.Robust data and targeting capabilities

The ability to plan campaigns around audience segments, not just locations, using mobility data, demographic trends, and contextual signals.Programmatic connectivity

Support for programmatic buying and optimization so you can tap into automation, real‑time bidding, and dynamic creative strategies in line with the rest of your digital advertising strategy.Measurement and attribution

Solutions that provide transparent estimates of reach, frequency, and impressions, alongside clear outcome metrics such as store visitation, online engagement, and sales lift.Strategic support and creative best practices

Expertise in designing DOOH‑ready creative (bold, simple, legible), aligning DOOH with other channels, and using contextual triggers to maximize performance.

Agility specializes in performance‑driven media across open-internet brand advertising channels, including DOOH. Agility helps brands turn DOOH into a measurable growth lever rather than just a brand awareness line item. Explore DOOH solutions with Agility to plan, activate, and optimize campaigns that connect real‑world attention with real business outcomes.

FAQs

Can DOOH be targeted to specific audiences?

Yes. Modern DOOH planning is audience‑first. Using aggregated mobility data and audience analytics, planners can identify which screens index highly for desired audiences (e.g., young professionals, shoppers, frequent travelers), build dayparted and location‑based strategies that align with behaviors, and layer contextual triggers (weather, events, time of day) on top of audience patterns so the right creative runs in the right moments. This allows DOOH to operate much like other data‑driven digital channels, but anchored in physical spaces.

Is DOOH advertising measurable?

Very much so. While DOOH doesn't rely on clicks, measurement frameworks are now well‑established. Common DOOH metrics include:

Reach and frequency – Unique people exposed and how often they see the ad over a campaign period, estimated using traffic and mobility data.

Impressions and dwell time – Estimated number of viewed impressions and average time people spend in front of formats like kiosks or transit screens.

Online actions – Increases in branded search, website visits, or app activity among exposed audiences vs. control groups.

Offline outcomes – Store visits, restaurant traffic, or sales lift in markets or audiences exposed to the campaign compared with baseline.

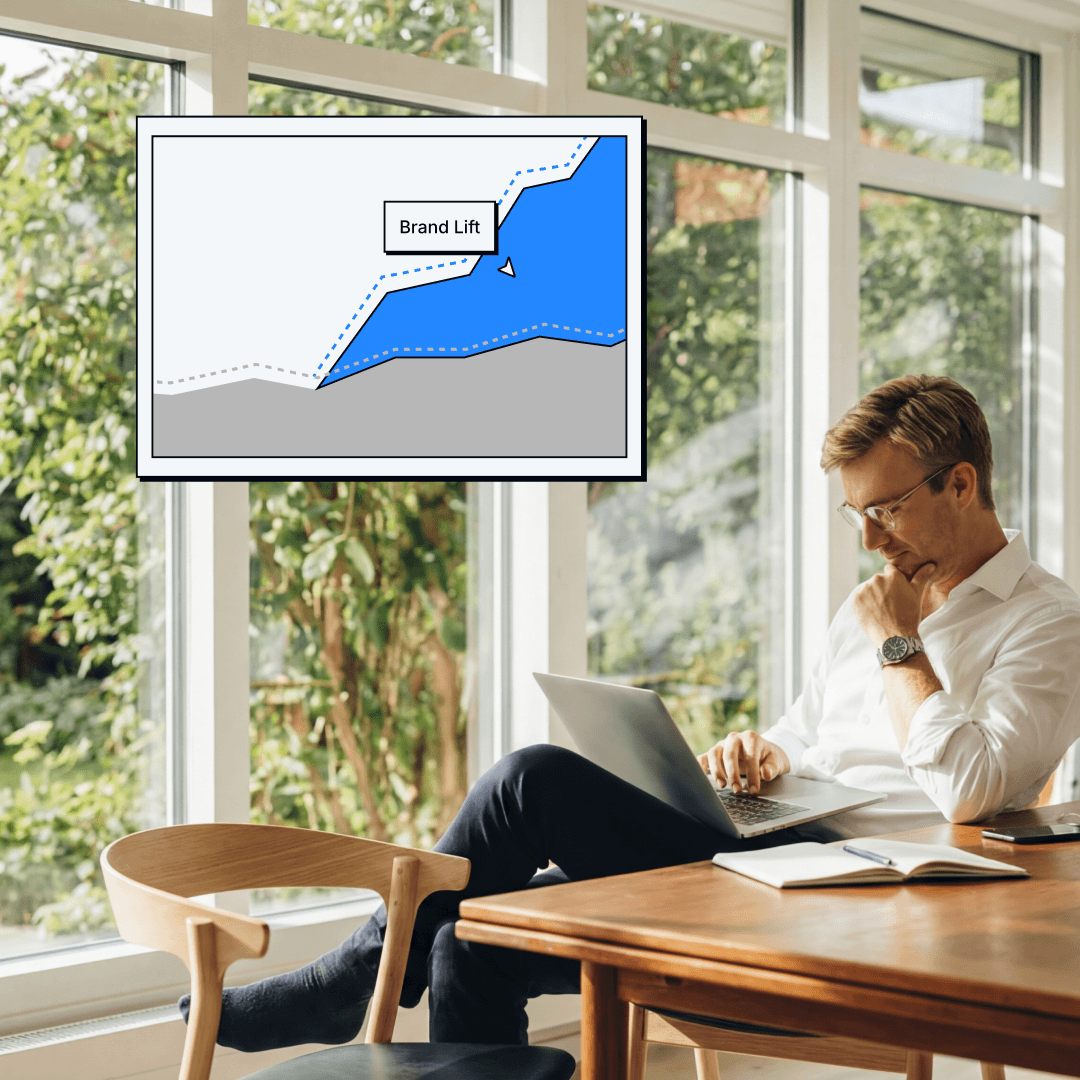

When integrated with a performance-oriented partner, DOOH can be planned, optimized, and reported on using the same rigor applied to other digital investments. Advanced partners like Agility go beyond standard measurement to provide incrementality analysis, isolating DOOH's true lift by comparing exposed audiences against matched control groups. This approach quantifies the incremental impact of DOOH on awareness, consideration, and conversion, demonstrating the lift it generated beyond baseline performance. By integrating incrementality measurement into DOOH planning and reporting, marketers gain confidence in real business outcomes rather than just exposure metrics.

Share in...